October 26, 2020

Financial institutions, your Cybersecurity is Strong. Shouldn’t the Access Control Protecting that Data be Just as Tough?

Financial institutions house immense amounts of sensitive data, from investment documents to personally identifiable information. Many organizations have lost this valuable data to malicious cyber attacks in the past and need to prepare for future onslaughts. Most financial institutions have a variety of cyber protections in place to process sensitive information and protect the confidential identities and financial investments of customers. Standard protections include outfitting physical premises with legacy access control systems, digital video cameras, and security intercoms; equipping IT networks with firewalls and anti-virus software; and securing website and email servers. However, despite these seemingly robust security measures, financial institutions are just waiting to get hacked.

Physical security and cybersecurity are inextricably interconnected and unless financial institutions invest equally in physical security, they will always have an exploitable weakness that puts their overall security infrastructure at risk. In order for these protections to be effective, it is essential that physical security standards for financial institutions are just as stringent as the current high standards for cyber security. Access control systems are a critical aspect of physical security as they ensure that only those with clearance can enter secure areas. Unless financial institutions begin to invest in and improve physical security measures like access control, they will remain vulnerable to security attacks and will start to drop out of compliance with mandated security regulations (such as PCI/DSS, GLBA, FINRA, GDPR, etc.).

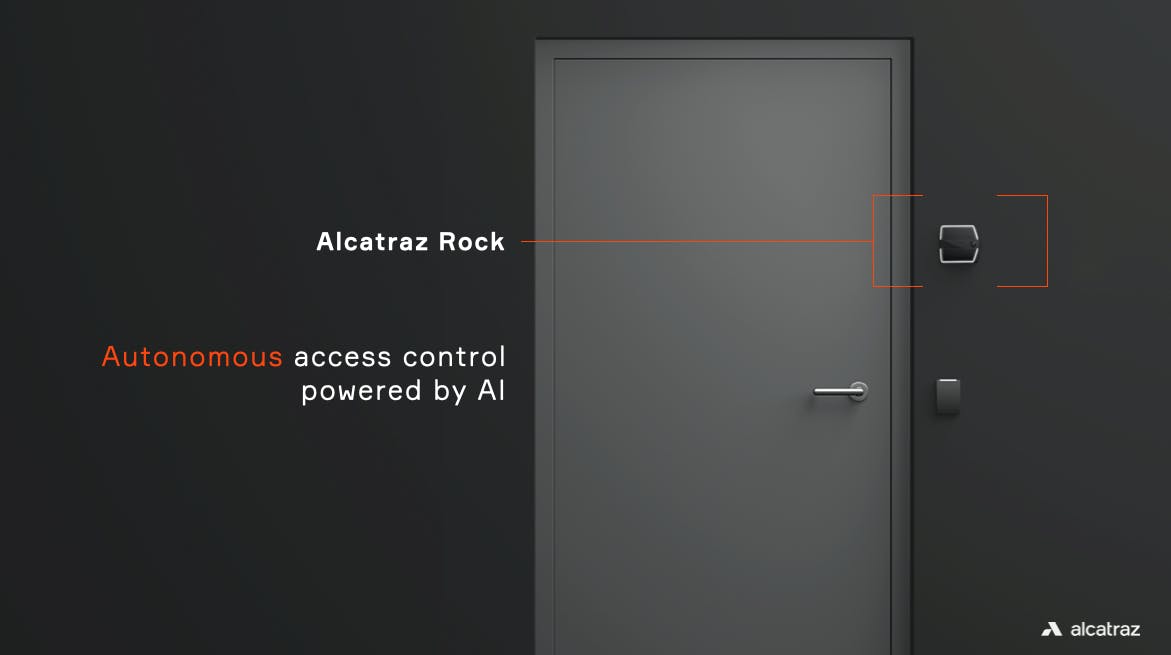

Fortunately, cutting-edge access control solutions, with the ability to bolster the physical security of financial institutions, are emerging on the market. Alcatraz AI is at the forefront with the Rock, a frictionless facial authentication access control solution powered by 3D sensing, artificial intelligence, and machine learning. The Rock seamlessly integrates into a financial institution’s existing access control infrastructure and provides the ultimate security with features such as touchless entry, tailgating detection, and more. The Rock reliably safeguards high value areas like data servers, cash storage, vaults, and safety deposit boxes – eliminating the need for posting high-cost security guards at each entrance. The Rock can be used as a one- or two-factor authentication system permitting entry based on facial authentication alone or a combination of facial authentication and a physical identifier, like an ID badge, which offers the ultimate security.

If cybersecurity for your financial institution is strong but physical security is outdated or lacking, then you are putting your financial institution at risk. Futureproof your access control, ensure perimeter security, and enforce compliance requirements with a modern biometric solution that seamlessly complements your current infrastructure with one of the most secure methods in existence: facial authentication.

To learn how the Alcatraz Rock can provide a secure environment for your financial institution, please sign up for a demo.

← Previous --

Next →

Tag(s):

Blog

Other posts you might be interested in

View All Posts

Blog

20 min read

| May 15, 2025

Unlocking Executive Priorities: Why the C-Suite Should Care About Access Control

Read More

Blog

4 min read

| November 19, 2021

What is Tailgating and Why Should You Stop It?

Read More

Blog

7 min read

| February 11, 2022

5 Physical Security Measures Every Organization Should Take | Alcatraz AI

Read MoreSubscribe to email updates

Additional content around the benefits of subscribing to this blog feed.